Digital Transformation

May 6, 2019

PUBLISHED BY Geoffrey Moore

Finding Your Path

“There is more than one way to skin a cat.”

It’s a family expression that I used to love until I actually thought about what the words meant. But the point still holds, and it applies particularly well to executive teams who have embraced the need to digitally transform but are still struggling to find the means.

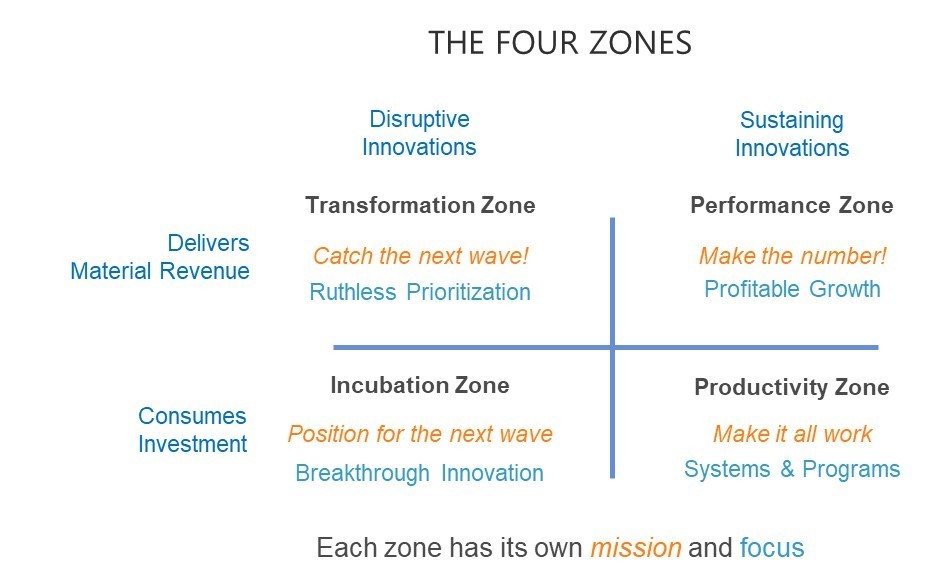

The zone management framework from Zone to Win lays out the landscape for any journey of transformation by calling out four zones of interest that must be accommodated one way or another during the process. In effect, it provides the map upon which you must chart your own path:

There’s a lot to unpack here, but for our present purposes, what matters most is simply to acknowledge the charters of each zone:

- The Performance Zone is charged with serving your customers and creating near-term financial returns. It represents the revenue generation arm of your business today. It provides the operating income to fund both your current and future operations.

- The Productivity Zone is charged with making the Performance Zone more efficient and more effective as well as insuring it complies with all regulations. It consists of all the cost-center functions that provide these services, an expense that is subtracted from your Performance Zone revenue, along with the latter’s cost of goods, to produce your operating income.

- The Incubation Zone is charged with exploring disruptive innovations that could potentially have an impact on the business at some point in the future. Back in the day, this took the form of a corporate lab; these days it is more likely to look like a venture start-up incubator. Any revenue here is de minimis, so effectively these are cost centers as well, but expenses here are normally small enough to ignore.

- The Transformation Zone is charged with driving an enterprise-wide change at scale, creating a net new source of earnings. Expenses to fund, staff, and accelerate this effort certainly cannot be ignored and have to be met by extracting sacrifices from the other three zones. This necessarily puts a big dent in your operating income, a short-term hit that alienates public market investors and puts your managing-for-shareholder-value reputation at risk.

The Transformation Zone, needless to say, is not a popular choice, and never one for the faint of heart. That said, in an era of digital disruption, it can represent your best chance to leapfrog the competition as a disruptor, as well as your best chance of keeping your enterprise afloat if you become targeted as a disruptee. What it does not represent, however, is familiar ground. So how exactly does it fit in with your more familiar operations in the other three zones?

It turns out there are at least four correct answers to this question, depending on who you are and what you are up to.

-

- The Start-Up. Begin in the Incubation Zone, leveraging venture funding, until you get to Minimum Viable Product. Then commit to crossing the chasm as your Transformation Zone effort, demonstrating your first great example of product/market fit, transforming you from an interesting bet into a going concern. From that position, ride a tornado of category growth based on increased adoption of your disruptive technology to achieve a strong Performance Zone position, ideally going public along the way. Then, as the category subsides, turn your attention to the Productivity Zone to stabilize and optimize your enterprise for the long term. Thus, what begins as a venture-funded journey transitions to public market funding, with each stage of the journey rewarding investors with highly attractive risk-adjusted returns. This is the Silicon Valley success story.

- The Founder-Led Transformation. Fast forward, and now you are a public company with a solid stock price and a strong vision about what wave of disruption to catch next. This time, however, there is no venture funding to cover the cost, so how do you proceed? Essentially, you follow the same path, funding your own Incubation Zone, which you can readily afford, and then your own Transformation Zone, which, unfortunately, you cannot. To go forward requires that the founder fund the transformation by extracting resources out of the Performance Zone and Productivity Zone budgets. At the same time, the founder must reframe the investor narrative to attract growth capital to take up the slack left by value capital exiting the stock. Needless to say, there is a lot of resistance on both fronts, as the enterprise is making a high-risk move that will result in short-term under-performance. As a result, this play is something typically only a founding CEO can pull off. In Zone to Win we called this playing zone offense.

- The Disruptor-Forced Transformation. Having enjoyed a considerable run as a successful incumbent, you now discover your core business is under direct attack, your customer base is defecting, and you must respond or risk losing your franchise altogether. You are not in good shape to do so, however, as the disruptive attack has undermined your profit margins, making funds for any transformation even more scarce than usual. Additionally, when it comes to digital, your whole operation, including both your in-house team and your partner ecosystem, is optimized to run the old playbook, not the new one. The only viable path forward is to neutralize the disruptive threat by modernizing your operating model sufficiently to reach a “good enough” state that will satisfy your customer base. The good news is that your customer base would prefer to stick with you provided you can show you are keeping up, but you do have to act fast. To do this, you must temporarily release your core business from the Performance Zone, exempting it from its current performance commitments, and put it into the Transformation Zone for a rapid overhaul, co-opting any digitally relevant efforts you may have already under way in your Incubation Zone, your goal being to get this business back into the Performance Zone as fast as possible, once it can compete on more even ground. Your traditional value-oriented shareholders will not be pleased and will likely defect, so you must demonstrate traction quickly before an activist investor swoops in to take your business in a whole other direction. In Zone to Win we called this this playbook zone defense.

- The Staged Transformation. This is by far the best option for an established enterprise to take, but it requires you to act with foresight before the barbarians are actually at the gates. Begin in the Incubation Zone experimenting with disruptive innovations until you find one you want to bet on. Then take it into the Productivity Zone, meaning apply it to your own internal operations, focusing on getting efficiency-based returns from optimization. This gives you an immediate return and lets you learn about the new technology “up close and personal.” Once you have confidence you have mastered the new playbook internally, then take it into the Performance Zone, applying it to your external-facing operations, focusing on getting effectiveness-based returns from modernization. You are still operating within your traditional business model, but you are leveraging digital infrastructure to do so in a more agile and customer-friendly way. Finally, put some people to work in your Incubation Zone analyzing the log files from your newly digitalized operations to determine if they contain signals that would allow you to develop a whole new line of business, along the lines of what American Airlines was able to do with its SABRE system back in the day, and what Google, Facebook, Uber, Airbnb, and Amazon are doing today. Because you are acting ahead of the curve, you may have the option to fund this new business off the balance sheet, thereby reducing the short-term pressure on your stock price. Regardless, you will have a great story to attract next-generation investors, thereby making the path through the Transformation Zone a lot easier.

Each of these paths has proven successful in its own right, but for any given enterprise, at any given time, there is likely only one that represents the best bet. Your job is to identify that one and avoid getting distracted by advisors who are applying one of the other models to your situation.