June 21, 2019

PUBLISHED BY Wildcat Venture Partners

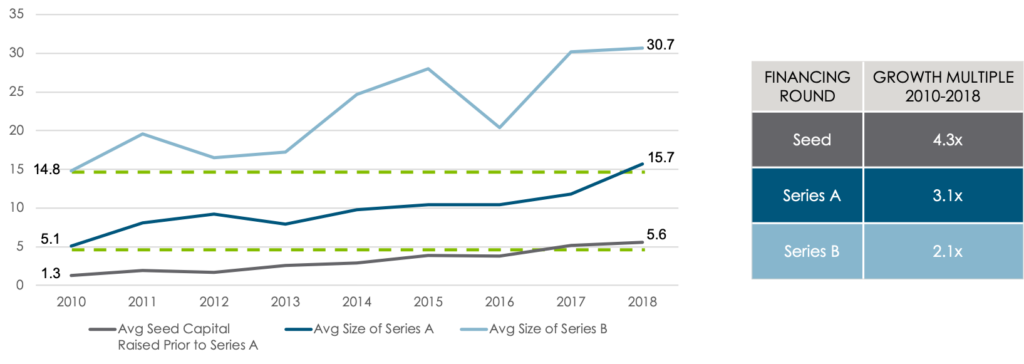

Over the last decade, there has been a fundamental shift in the way venture capital is being deployed. “Early stage” funding has dramatically changed with initial rounds measuring in the $Ms and correspondingly high valuations.

Today’s “Seed” rounds have essentially become yesterday’s “Series A” rounds. And today’s “Series A” rounds have become similar to the overvalued “Series B” rounds of the early 2000s. Private valuations are soaring amid free-flowing capital while the absolute number of early stage investments is decreasing as fewer companies are able to secure true early stage funding.

Chart Source: TechCrunch

Why are large funds investing more capital at the Seed and Series A financing rounds? How is this changing the venture environment and what does this mean for the future of venture investing? More importantly, what does this mean for the next generation of entrepreneurs who are trying to turn their ideas into successful, scalable businesses?

The Rise of the $1B+ Venture Funds and Outsized Rounds

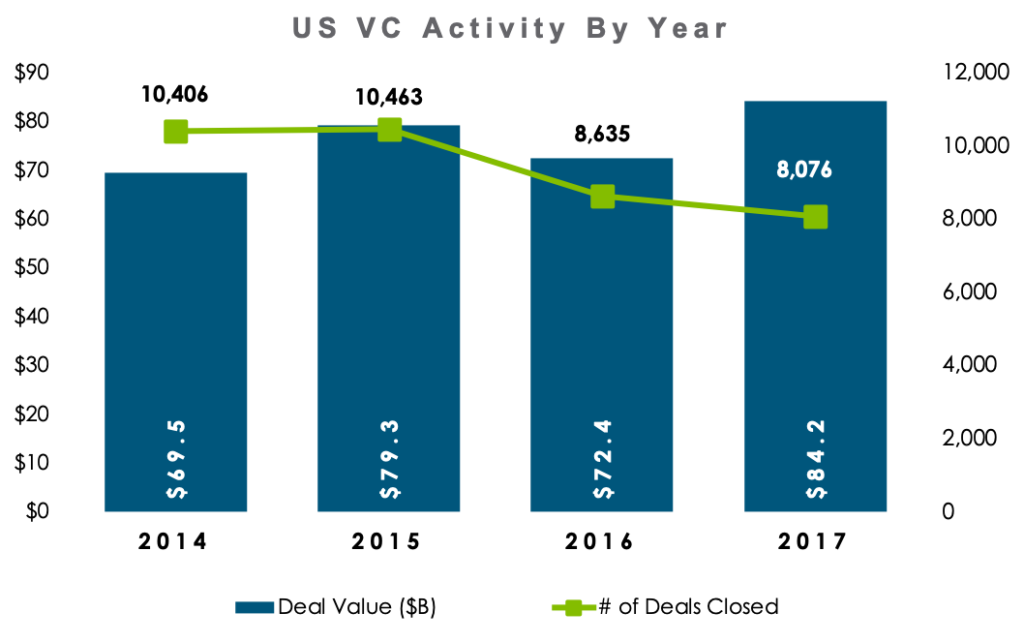

Data shows that venture capital firms are putting more capital to work in fewer companies. According to the NVCA, while the total US venture funding dollars increased by 21% from 2014–2017, the total number of rounds decreased 22% into 2018.

Chart Source: NVCA

Industry statistics collected by the NVCA and other researchers also show that fund managers in nontraditional asset classes, such as venture capital, are putting more money into larger funds. For instance, ten years ago Sequoia was managing a $300 million fund. Now it has raised and manages a massive $8 billion global fund. And an increasing number of venture firms have also raised previously unheard of $1B+ funds.

If you have a $1B+ venture fund, simple math dictates you deploy $20-$30 million into each portfolio company in order to keep the overall portfolio to a manageable size of say, 50 companies. This has generated experiments with capital that we have never seen before.

For example, the legal startup Atrium was founded in 2017 and raised a staggering $65 million in September 2018, a little after its first birthday. Zenefits raised $500 million in a series C round that was right on the coat tails—11 months to be exact—of their $66 million Series B.

The recent increase in the size of funding rounds has also contributed to inflated valuations north of $1 billion. In 2006 there were 7 “unicorn” companies in the US. In 2017 that number grew to 73, and as of January 2019, there were more than 150 “unicorns” in the US.

What is yet to be seen is how well these highly valued private companies will be able to justify their valuations in the public market. There have only been 31 unicorns to IPO since 2012. This low number could, in part, be due to high valuations being unattainable in the public market.

The Shift in Early Stage Venture

So where does this leave true early stage startups?

Ten years ago, the average Series A financing was around $5 million, but in 2017 80% of series A financings were more than $10 million, with over 50% hitting the $25 million (or more) mark.

With “early stage” financings becoming the size of traditional “mid stage” deals, there are vast amounts of capital being injected into immature companies that are ill-suited to manage it responsibly.

These larger pools of capital are meant to finance the scaling of organizations where product-market fit and sales repeatability have been achieved. But the reality is that many of these companies have yet to generate what could even be considered a truly minimum viable product.

The truth is more capital doesn’t always mean more success. And early stage startups shouldn’t be lining up to take in more capital just because certain investors want to put it to work. Doing so can hide poor business models, products, and governance. Early stage entrepreneurs should be focused on reaching key product and business milestones and not wasting time and resources determining how to deploy large stacks of cash.

The age of startups raising early rounds of financings has also increased significantly over the last decade. The median age of a startup raising a Series A has increased by 1.5 years to a present record high of 3.6 years. A similar dynamic is at play with companies seeking Seed financing. The median Seed round company in 2017 was 2.4 years old—almost half a year older than the median 2-year-old Series A company in 2007.

The Special Sauce – How to Align Startup Classifications

With such a drastic change in the early stage investing landscape, it begs the question “Is there a better, more precise way to evaluate, value, and compare the maturity of early stage companies; something other than their financing rounds?”

As an industry we have redefined the early stage investment environment but have yet to redefine the vernacular for evaluating that environment. Funding rounds are clearly no longer—if they ever were—an adequate measure of a company’s maturity since the age of companies raising similar rounds can vary greatly.

Rather than using vague funding terms such as “Series A” or “Series B”, or “Growth” we need a defined set of metrics that the industry can use to measure and compare the true maturity of a startup.

Such an approach would provide answers to the important questions—Does the company truly have a minimum viable product (MVP)? Is it prepared to scale? What milestones should they hit before we inject more capital?

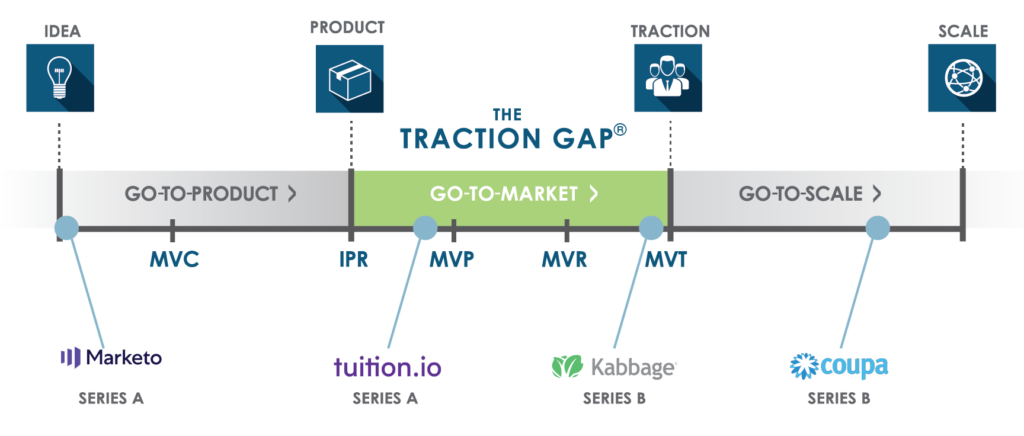

Enter the Traction Gap Framework®—a clearly defined and codified set of principles and metrics that addresses each phase of an early stage startup’s journey from ideation to preparing to scale.

Wildcat Venture Partners developed this framework as both an investment decision model and as an early stage operating playbook for our portfolio companies.

The Traction Gap is the period between a startup’s initial product release (IPR) and the product’s ability to generate traction in the market. What is considered to be traction can be subjective, but it is typically correlated to the velocity of revenue growth, user engagement, downloads, usage or other variables that suggest market acceptance and signal a positive growth trajectory.

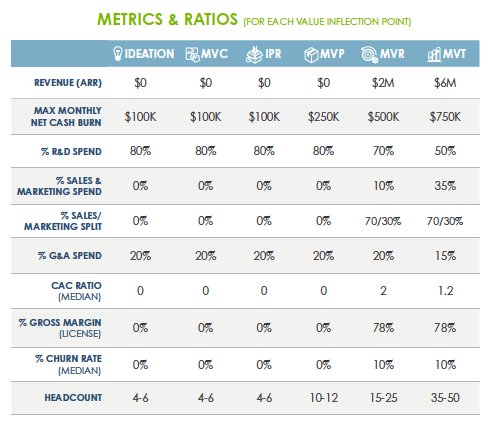

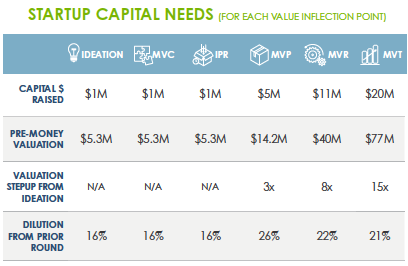

Startups must successfully reach a series of increasing value inflection points along the Traction Gap Framework continuum. Each value inflection point provides a startup with a way to define their progress and maturity and allows for transparent communication with current and potential investors around achievements, challenges, and risks.

The Traction Gap value inflection points are defined as follows:

- MVC – Minimum Viable Category. Category defined/redefined along with its attributes

- IPR – Initial Product Release. First publicly deployed product iteration

- MVP – Minimum Viable Product. Product in market with minimal customer validation metrics

- MVR – Minimum Viable Repeatability. Solution -grade product, business model, and repeatable sales/marketing

- MVT – Minimum Viable Traction. MVR + multiple quarters of growth

Each value inflection point directly equates to a step-function change in valuation for a startup. That is, not only are these market-development milestones, they are venture-funding milestones as well.

As a result, the framework directly aligns the entrepreneur and the investor on how a specific funding event translates into a subsequent uplift in company valuation.

You can find more information on the Traction Gap Framework here.