In Search of a Venture Firm

February 12, 2018

PUBLISHED BY Bruce Cleveland

SOURCE Wildcat Venture Partners

Most savvy entrepreneurs know that getting a warm introduction to a venture firm substantially improves their odds of getting a meeting — and hopefully an investment.

But, what if you are an entrepreneur and don’t really know anyone at a venture firm?

Many are now using LinkedIn to initially contact potential venture investors. I get a lot of unsolicited requests from entrepreneurs this way. I pass on almost all of them for a variety of reasons but I always try to quickly scan the opportunity and provide thoughtful reasons for why I’m passing.

Most follow up by asking me if I can suggest other venture firms/partners that might be interested in their startup.

I always tell the entrepreneur they really don’t want me to do that.

Why?

It comes down to basic human psychology. No matter what I may say, the investor receiving my introduction, even if briefly, thinks…

You don’t need that overhead.

So, if you don’t have a relationship with a venture investor or with the firm or investor you really want to speak with or know anyone who does — how do you get an opportunity to present your idea/startup without that “warm introduction”?

I’m going to give you an approach — along with some simple modern tools you can use — to increase the likelihood of getting that meeting.

Which Venture Firms and Partners Should You Target?

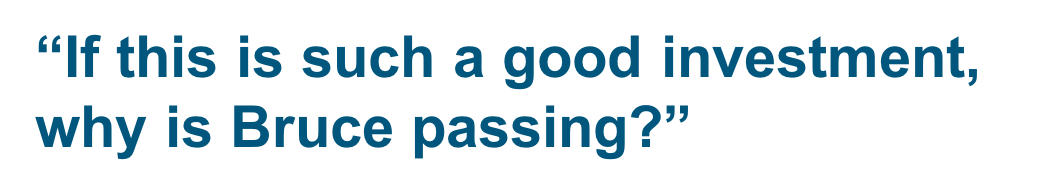

Venture firms and their partners tend to invest across two dimensions — investment stage and investment type. Seldom do firms invest in all stages across all investment types — only the largest firms can afford to execute this strategy.

A venture firm may invest from very early stage (e.g. ideation/pre-revenue) to late stage (e.g. scaling) and across a variety of investment types around key markets, technologies, and business models.

Some venture firms raise funds to go after specific areas such as early stage, late-stage, technology-centric (e.g. blockchain), market-centric (e.g. fintech), or geo-specific (e.g. china) startups.

Each of these funds have been marketed to Limited Partners explaining the firm’s investment theses, unique insights, strategies, expertise, and projected returns.

So, how do you find the right firm with the right fund and/or the right partner that aligns with your startup?

First, you need to answer the following questions:

1. What stage is your startup?

2. Which companies participate in your market?

- Competitors?

- Companies in the same market but a different sector and not a direct competitor?

That was easy. Now, you are ready to use Crunchbase.

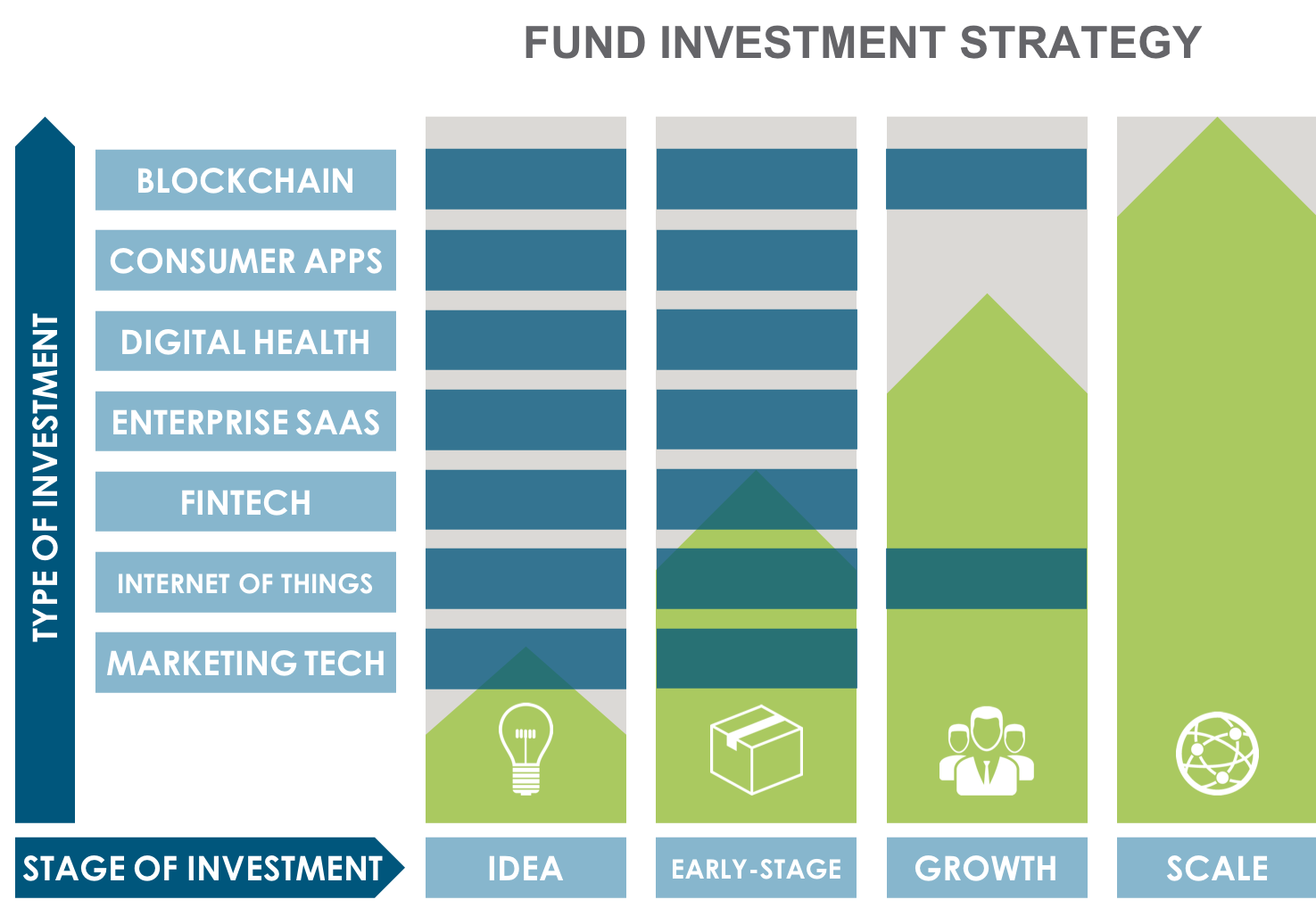

Take your list of all the startups you consider to be competitors and search Crunchbase to discover who their investors are. These are venture firms and partners that aren’t as likely to invest in your startup so you may want to steer clear of them initially.

It’s just as important to know which firms and partners you aren’t going to target as it is to know which ones to target.

Next, make a list of startups that you believe operate in the same market as your startup but don’t consider to be direct competitors.

Go into Crunchbase and find out which venture firms and which partner in the firm invested in these companies and at which stage they invested — this is key information.

Mid to late stage investors, for example, don’t typically invest in early stage startups. So, spending effort trying to convince firms/partners that don’t invest at your current stage is a waste of your valuable time.

If a firm hasn’t taken the time to update its Crunchbase profile, then the partner who made the investment may not be named. Therefore, you may need to go to the venture firm’s website to discover which specific partner made the investment.

Now, you have your initial target list of venture firms and partners and are ready for the next phase.

Developing Your Message

Ok, you know the firms and the partners you want to target. What’s next?

You need to develop a “native ad” for LinkedIn with a compelling visual, message, and call to action (CTA) that encourages your prospective investor to click; it’s that straightforward.

You don’t need a design team or marketing agency to do any of this; the tools you will use are inexpensive, easy to learn and, in most cases, built into the platform you will use to distribute the ad.

Your ad should include a link to the home page of your website. Better yet, the link can be to a unique landing page that quickly informs your prospective investor about what you do and what you are seeking. This isn’t the time or place to tell your complete story; all you are trying to accomplish is to get a meeting.

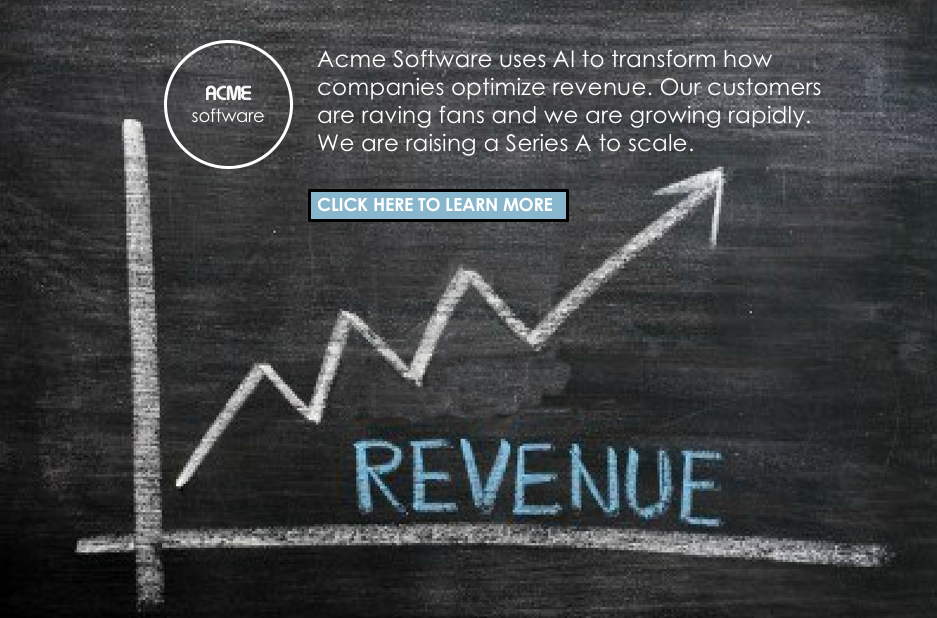

What visual should you use for your digital ad?

It should include your company logo and a graphic or image that best represents the market you serve or the product you’ve developed.

If you have a short video clip that you can overlay with your logo, all the better. Video has been demonstrated to perform better — higher click-through rates — than static images. You can easily purchase all types of stock, short video clips.

What should your digital ad say?

Your message should be brief and compel your prospective investor to want to learn more about you. You don’t need — or want — to tell them everything in the digital ad — you just want them to click on the ad.

Your message might be something like:

These ads are only going to be seen by prospective investors who have demonstrated an investment interest in your company’s category. So, you can be direct about the fact you are seeking an investment. Your call to action is simple: click here to learn more.

While you can opt to just take someone to your website — if you have one — you are far better served if your ad takes them to a custom landing page that tells the investor exactly what you are seeking.

There are many low cost products in the market to develop a landing page and you can find them in a simple search. So, I’m not going to provide you with a list of them here.

More important is what you say on your investor-specific landing page.

What should you say on your landing page?

Your objective here is to get a prospective investor to meet with you so you can tell your story. So, you want to say enough to be compelling but not a tome.

Here is what your landing page should contain:

- A graphic, photo, or video clip — something that is visually interesting and relevant to what you do, your logo, and your website url.

- A short narrative about your company — a few sentences that tell the investor who you are, what category you are creating or redefining [read Play Bigger to learn more about category creation], what “big problem” you are solving, and some preliminary results, if you have any.

- A positive quote about you or your idea from someone who has credibility (an executive in a notable company or a professor from a good school). This is your “digital warm introduction”.

- Your ask — Simple. You want to meet to tell your story, explain how much you are raising, and how you will use it to accomplish key objectives. The landing page should be written from the point of view of the CEO/founder and provide her or his direct contact information. Investing in your company is personal. You are asking the investor to stake their reputation and potentially put their career on the line by making an investment in you. Raising capital is not a task the CEO can delegate to others.

Getting Your Ad in Front of the Right People

Fortunately, everything you will need to execute your ad campaign is on LinkedIn. All you need is a company page.

Once you have your company page and your native ad created — or a few versions of them — you can use LinkedIn’s LI Audience Network, and account and contact targeting to cost-effectively target specific companies and people in those companies with your message.

These tools allow you to directly target your ads to specific firms and even specific partners in those firms (if you have their email addresses) with LI sponsored posts. In addition, you can also use these tools to target the same firms and people on key third-party publisher apps and websites outside of LinkedIn.

You can limit the amount you spend on any given day either from direct clicks (CPC) or ad impressions (CPM). The tools will tell you the typical bid/ask range for similar ad campaigns, so you can budget accordingly.

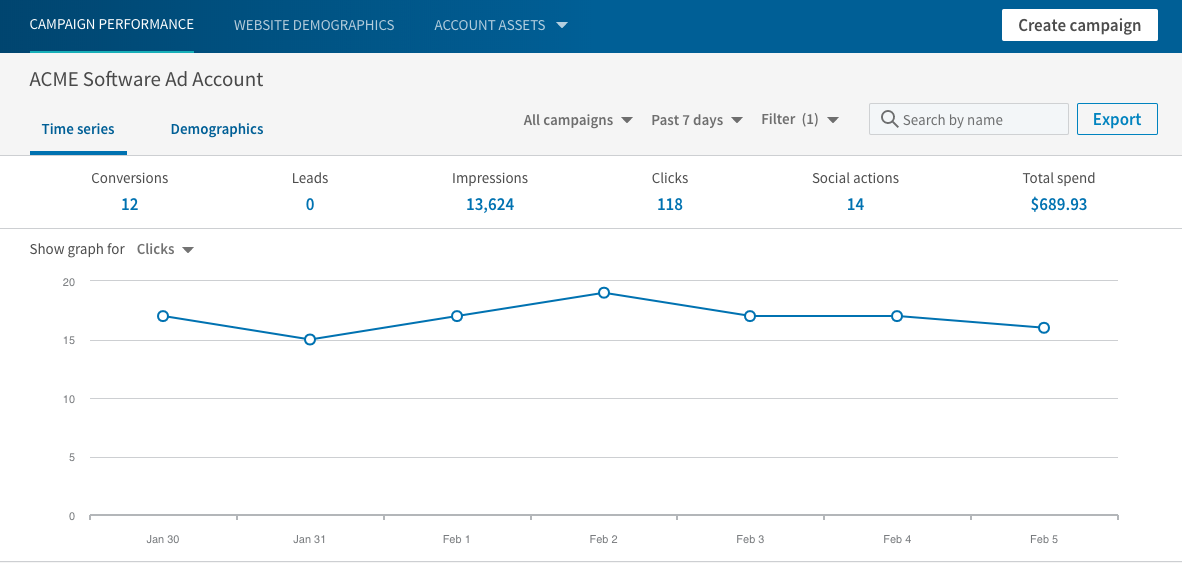

You also get some basic analytics on how your ads are performing — conversions, impressions, clicks, social actions and what you spend.

Adding Email to the Mix

If you want to take your campaign to the next level and make it more effective you can follow up your ads with targeted emails.

Companies such as discover.org can provide you with the specific email addresses of everyone you want to target. However, these solutions can be expensive and require someone on your team to set them up (as if you have such resources!).

A far less expensive route is to use one or more of the tools recommended here and use an intern (or you) to find all the email addresses you are seeking.

Then, you should use MailChimp (cheap) to create a targeted email to every partner in the firm, reference the digital ad you’ve been targeting them with, and ask for a meeting — don’t forget to include that “digital warm introduction” you used on your landing page. The reason you want to use MailChimp is that it allows you to easily track delivery and open rates and by whom.

Summary

Venture investing is a relationship business. If you want a 21st century venture investor to invest in your company and you don’t have personal relationships with the ones you want to meet with, don’t use 20th century techniques.

Take advantage of these low cost approaches to get in front of and convince the venture firms and partners you want to meet with that you’re on top of your game.

KEYWORDS